26 June 2019

Lodging your tax return is easy when you have everything ready that you will need.

When completing your tax return, you may be able to claim deductions for some work-related expenses.

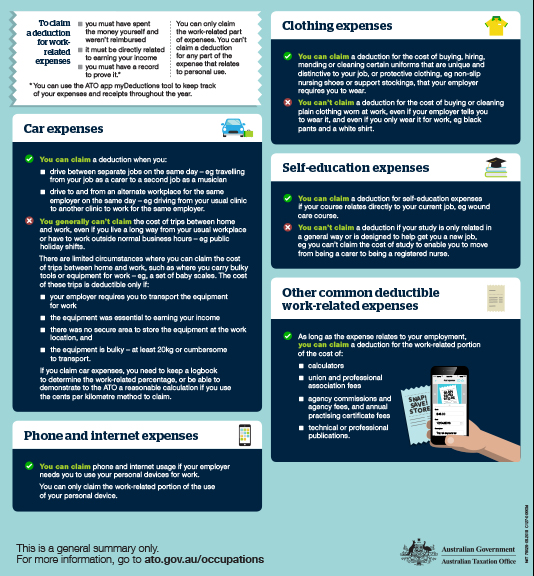

To claim a work-related deduction:

- you must have spent the money yourself and weren’t reimbursed

- it must be directly related to earning your income

- you must have a record to prove it.

If the expense was for both work and private purposes, you can only claim a deduction for the work-related portion. Deductions for nurses may include:

- travel expenses

- clothing expenses

- self-education expenses

- home office expenses

- phone expenses

- tools and equipment

- other expenses.

You are accountable for the claims you make in your tax return, even if you use a registered tax agent to prepare and lodge it on your behalf. There’s no such thing as a standard deduction – this is a myth. There’s no ‘safe’ level to claim a deduction where you haven’t spent the money or it’s not related to earning your income. Make sure you have records to prove your claims.

The best time to lodge your tax return is mid-August, when all financial information the ATO receives from employers, banks, government agencies and more, will be pre-filled. You must also remember to declare all income when lodging your tax return.

For more information go to www.ato.gov.au/nurse.